No audio available for this content.

Do you remember the free-standing car navigation devices that were popular for a while, such as those made by Garmin and Magellan? Few people use them anymore because to find our way when driving, most of us use our smartphones instead.

Smartphones now have a plethora of sensors, including inclinometers, accelerometers, magnetometers, barometers and light sensors. However, cost and size constraints (the insides of those small devices are so crowded!) limit the accuracy of smartphones’ GNSS receivers.

Therefore, to accomplish professional mapping tasks, it is now increasingly common to pair a smartphone — which provides computing power, a display, motion sensors, a camera and Internet connectivity — with an external GNSS receiver and antenna.

This and other changes in the industry make product categories long in use obsolete or, at least, less compelling. What is a mobile GNSS solution? Are the terms “mapping grade” and “resource grade” still useful? Who is using which devices for which tasks?

I discussed these issues with Bernhard Richter, VP Geomatics at Leica Geosystems, which is part of Hexagon, and with Igor Vereninov, CEO of Emlid.

— Matteo Luccio, Editor-in-Chief

Leica Geosystems: Conversation with Bernhard Richter, VP Geomatics at Leica Geosystems, part of Hexagon

We used to divide GNSS receivers into consumer grade, resource grade (for GIS data collection) and survey grade.

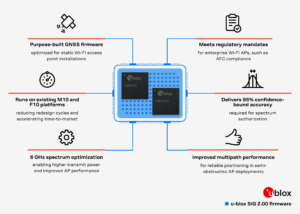

Those lines don’t exist anymore to the same extent. Some of the lower-cost chipsets — which were originally built for mobile phones and Garmin devices and lower-accuracy stuff — can now provide higher accuracy. We call them industrial-grade chipsets. The need for UAVs, e-scooters, e-bikes, automotive applications, etc., triggered their development. They are coming closer to the premium boards — let’s call them the multi-frequency, multi-constellation receivers that were always built for real-time kinematic (RTK)-type applications.

So, it’s the bottom that’s coming up.

There is still a need for single frequency code-only chips on the one hand for the mass market and, on the other hand, for premium devices from companies such as NovAtel (part of Hexagon), Trimble, Hemisphere and Septentrio. There is a new tier, which we call industrial grade, from companies such as u-blox and Unicore, which come a bit closer to the premium segment.

I’ve always thought of location-based services (LBS) as using consumers’ locations to connect them with retail and services. People use their smartphones to find the nearest coffeeshop, but what has not happened is coffeeshops saying, “Hey, I see that you are within 500 feet of our store. You should come in, because we’ll give you a discount.”

In our field, we make money by providing decimeter- or centimeter-level solutions to our users for surveying, machine control, GIS, etc. When it comes to needing locations for other applications, such as retail, everything is already nicely integrated in smartphones, and consumers just utilize what is there.

In order to get a better precision than the one provided by the cellphone, you need a small, extra GNSS device connected to the cell. Then, instead of using the position provided by the phone, the application will use that much better position. That trend will go on for quite a while. This is the change to what was standard in the last decade, when we built dedicated handheld controllers with fairly high-cost chipsets to enable GIS applications. These GIS devices seem to be disappearing. It’s either an Android or iOS-based phone or tablet, and now you add a hockey puck-type GNSS antenna. Then, you override or mock the position that is coming from the internal chipset on the phone, and the app uses that more precise position. That is the new standard for GIS, so to speak.

Analogously, for a decade we had dedicated car navigation devices. They disappeared because our phones now do that.

Exactly. Where we can really add is in providing that extra bit — not only hardware, but also software and services. Decades ago, we developed the HxGN SmartNet RTK service. Now, we also have HxGN SmartNetGlobal, which is both a terrestrial-based service and augmented by a satellite-based precise point positioning (PPP)-type service. Simple car navigation devices such as those by Garmin or dedicated GIS controllers have almost vanished. It’s always a smartphone or a tablet plus, if a centimeter-level solution is needed, an additional device.

It does not make a lot of sense to fully integrate high-precision GNSS into these mobile devices, because the customer group who really needs a centimeter-type solution is too small, and it would put an extra burden on the engineering for the tablet or the smartphone. Nobody complains if you attach a device that weighs a few hundred grams. I also think that you shouldn’t integrate things that don’t belong together. The different components have different life cycles. A smartphone today is old when it’s 18 months old, right? But, with the volume that’s sold to customers needing high precision, we cannot renew the equipment every year.

Are you talking about a smart antenna?

Today, a GNSS chipset can be as small as a two-Euro coin. However, if you want to do high-precision GNSS, you still need a decent-sized antenna. So, you cannot go to a fingernail size with the antenna element. If you need a good amount of multi-pass mitigation in the analogue way, you need a beer coaster-sized ground plane. Now, typically, you also put in a MEMS-based inertial measurement unit (IMU), so that you do more than just the pure GNSS position — pitch, roll and yaw are important as well.

Phones already have IMUs.

It’s always a matter of what you want. Do you want five meters or one meter or sub-decimeter repeatable at high reliability? Then you need to add more, higher-value components, right? Also, if you just take what’s in an iPhone, it’s not so easy to calibrate those MEMS. Engineers could probably solve the problem, but precision is never the primary goal for a smartphone and would increase complexity.

In addition, in an iPhone, you don’t really worry about aging of the components or whether they can survive a fall from 1.5 m. So, we look at the application and the environment in which the customers are using it, then we select the best components to really add value to, let’s say, the existing iPhone’s position.

In September, we released a high-grade antenna about the size of an ice hockey puck with a very small and tightly integrated GNSS chipset and inertial measurement unit (IMU). Then, of course, we have our own processor to run our positioning engine. It brings in all the corrections that we can provide with our SmartNet service. So, we provide a centimeter solution and pitch, roll and yaw in the most compact form.

Then the phone becomes just the interface.

Yeah, the phone position gets mocked by the position, for example, from a FLX100 plus, and the app takes the better position.

The app is the user’s interface with the puck.

Yes, but the survey device — the “GNSS puck” together with the phone running the app — is only one element of what a typical GIS user needs. Most important are the data themselves and the cloud system that hosts them. The data are the key enablers. If you think of Esri, for example, their value is hosting the data, having the geospatial relationship between the data and enabling decision-making.

The geospatial acquisition part became really easy and can even be done in a tilt-compensated way, so you don’t even need to level your survey pole. The surveyed points are typically automatically synchronized or uploaded to the cloud system. So, if you say that the phone is just the user interface, I kind of disagree.

You’re collecting data and feeding them to the cloud, but they are also on the device to display.

The data themselves are only stored inside the app or in the cloud and can be displayed. The GNSS device itself keeps streaming the position but nothing gets stored there.

How much do you collaborate with ESRI, in terms of their application and the data?

Jack Dangermond [Esri’s co-founder and president] once said, “portal to portal is key these days.” At Hexagon, we have our applications, our industries and our focus areas, and ESRI has its. To me, the way to be successful is to have systems that are compatible and portals that can talk to each other. So, to me, portal to portal is and will be key.

You mean the portals in the cloud?

Yes, they have an API interface and they can talk to each other. I’ll give you one concrete example. We have a product called the FLX100. It is a little puck, has a helix antenna, a receiver engine, but does not have a cellular phone integrated. We’re using the cellular connection of the user’s mobile phone. So, you connect the mobile phone to the FLX100.

We have software called Zeno Mobile One that has an Esri interface. So, we can immediately synchronize everything we measure with ArcGIS Online and ArcEnterprise. This is how we developed our GIS asset collection software. We need an accurate position, of course, which we provide through the hardware that we sell with the FLX100 plus. It can also connect to any RTK service — but, ideally, we connect to our own SmartNet service. As soon as we collect an asset — such as a pipe, a fire hydrant or a manhole — the operator annotates it, “This is a manhole, this is a gas pipe, this is a water pipe,” whatever. Then, the data can be uploaded immediately, already in the right file structure, e.g. into an Esri environment.

We can also run an Esri product, such as ArcGIS Field Maps, on the smartphone and still talk to our hardware. This is very interchangeable these days. If you’re not doing this, I think you limit yourself too much when it comes to data collection. We understand the whole workflow much better than in the past and can be open to certain services, such as Web Map Service (WMS) or Web Feature Services (WFS). You can download the map of your town, then download, let’s say, the entire public water system and load it into this map. Then you can make changes, add new pipes, etc. So, there are many services that enable you to add to an existing map.

So, you’re using Esri’s APIs like anybody else.

Theoretically, you’re right; we use those published interfaces. However, we are Esri Gold Partners, so we really work with Esri to make this happen. There are also open-source products, such as QGIS.

What do you mean by “industrial-grade” receivers?

UAVs doing high precision photogrammetry are one of the biggest market for RTK positioning. However, the highest-end boards from the likes of NovAtel (part of Hexagon) and Trimble are less often used in these applications nowadays. So, UAV manufacturers and operators switched to smaller, lower-cost chipsets. This is one area where this field developed. We are talking about hundreds of thousands of UAVs. So, it became a significant market.

Also, today lawn mowers do not just follow random patterns on lawns. They start integrating those more high-precision chipsets. These days, they are more and more multi-frequency, multi-constellation.

Who’s using something like the puck that you were describing earlier? It’s neither average consumers nor surveyors.

It’s a very good question. We still need to differentiate between the high-precision geodetic market or the scientific market where highest reliability is needed and the GIS market where reliability is of lesser priority. In many cases, such as high multipath, foliage coverage and jamming — there are typically no anti-jamming tools on these lower-cost chipsets — there is a strong need for highest end GNSS cards and a significant difference. Nevertheless, the GIS market is still of significant market size.

Every fiberoptic cable that’s being put underground these days in countries such as Germany, Austria and Italy must be mapped on the open trench. It would be quite costly for those companies who put the fiber optic cables into the ground to call a surveyor each time. So, they train their own technicians to do the job and need many handheld units. We have customers who need 100 crews equipped with the same GNSS equipment. That is the kind of customer group that needs this mid-tier of products.

There are other markets for the mid-tier products, such as photogrammetry, which is coming back because of the improvements in digital cameras and the power of the processors in the field, and then everything with augmented reality. This customer group still needs some control points or RTK positions, but they typically don’t want to spend too much on highest precision equipment.

What is new about the FLX100 plus?

We integrate it into the world of mobile devices in a new way. It is a change from an integrated handheld controller to something that’s separated from the tablet or the smartphone. From an accuracy point of view — if we’re not talking about very challenging cases such as heavy foliage or multipath and 50 km baselines — the FLX100 plus is really good. I think we are at the level where we were with the highest-grade GNSS equipment in 2005 or 2010.

At GPS World, we have used the term “mobile solutions” for a long time but, as the technology changes, it’s hard to use the same categories.

The mid-tier and high-end premium will increasingly blur. So, there isn’t such a clear line anymore. The distinction will disappear, not the equipment itself, for those who want the highest reliability — such as surveyors, who typically earn their living by putting their stamp on a map or a plan and are liable for errors. These customers want the best possible also under very difficult conditions.

Emlid: Conversation with Igor Vereninov, CEO at Emlid

What does Emlid do? How large is it? Where is it based?

We build high-precision RTK receivers and software for them. We are based in Budapest, Hungary, and we also have development offices in Belgrade, Serbia, as well as in Lisbon, Portugal. We are more than 100 people now. We are a diverse bunch, developing everything inhouse — including electronics, embedded software, mobile applications, cloud services and beautifully designed enclosures.

Why did you start the company?

I started the company with my co-founder out of my kitchen, 10 years ago. We started with the idea of making RTK more affordable. Back then, survey gear was very complicated, required a lot of training and was super expensive. We were maybe a bit arrogant, being just out of university, and we thought, “Yeah, we should definitely try to disrupt that.” We built super-affordable receivers, completely crowdfunded on Indiegogo, without any outside capital. Our personal money was very limited, so all the money we had in the company came from our future users.

At that time, our receiver was just a board, but from there we saw so much interest and the orders started to flow. We realized, “Okay, this is going to be big, so we better build a fully recognized and waterproof device that surveyors can use in the field and is not just for DIY hackers and geeks.” That’s how it started.

What came next?

We first had the Reach receiver, which was the board, then the Reach RS, the Reach RS+, the Reach RS2 and the Reach RS2+. Now, we have our Reach RS3, which is super-popular worldwide. We’re now widely known, and our receivers are still very affordable, robust, easy to use and as accurate as any other receiver out there.

To me, the term “mobile solutions” refers mostly to data collection for GIS, but these categories are very subjective. What are the key trends you see in the industry?

A big industry trend is that more and more people inside companies are interacting with centimeter accuracy and with RTK. Previously, it was only surveyors, but now we are seeing that an increasing number of people in the field will have access to accuracy. We play a large part in this story because we democratized RTK and brought it to other professionals outside of surveying.

Traditionally, we had RTK accuracy at one end of the spectrum, a GPS receiver inside your iPad or iPhone at the other end of the spectrum, and in between sub-meter devices, which traditionally occupied the GIS space. Now, customers and potential customers tell me that the sub-meter category is becoming less and less present and attractive. As the RTK technology becomes super accessible and affordable, all the consumers from the sub-meter space are shifting toward centimeter accuracy. Maybe they don’t really need it in the field, but they feel like …

They might as well have it!

Yes, why not just have it, right? It’s the same cost, so why not equip our field crews with centimeter accuracy? We now have easily accessible and affordable, or even free, correction networks. The devices themselves now cost less than $2,000 and are easy to use.

That’s the kind of conversation we are having regularly with customers and potential customers. They’re saying, “Why not have it?” They want to upgrade the accuracy of their mobile mapping device — typically, an iPad. It’s not enough to be able to tell, for example, on which side of the pipeline the valve or junction box is. They really would be fine with 10 or 20 cm of accuracy, but then why not go to that 1 cm level?

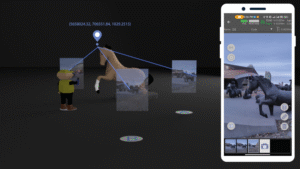

Another trend is using iPhones and high-precision GPS for site documentation. We now have deployments of hundreds of units in the field using a combination of an RTK GPS receiver with lidar and camera sensors inside consumer-grade devices, such as iPads or iPhone Pros, to document such things as accidents and construction progress — especially for large infrastructure projects, such as fiberoptic networks.

Your Reach RX, for example, is an external device that talks to a tablet, right?

Yes. We’re seeing the use of our receivers in combination with the sensors inside an iPhone to document objects with very high accuracy and with absolutely no training by the person doing the job. You really don’t need a trained person to do it. For example, an excavator operator — who is not typically doing any kind of mapping but is a professional in a different space — would be able to grab an iPhone with an external RTK receiver and map things with centimeter accuracy for reporting purposes.

I find it very exciting that we’re able to use this mix of consumer-grade technology with RTK that is rapidly becoming very affordable. Together, they give us a platform that allows us to document things super-efficiently and bring it into the hands of more professionals. We are seeing more and more startups in that space as well.

All your receivers are GNSS receivers, correct?

Yes, everything that we make is all-constellation and multi-frequency GNSS.

What are the main end-user applications for your devices?

We sell a lot to land surveyors and to drone pilots. Many drone pilots are increasingly becoming surveyors, and many surveyors are increasingly becoming drone pilots. So, those two groups of people are moving toward each other, and we are happy to serve both. Our devices are very popular and are the standard for drone workflows. This is a big market for us. Also, construction and mobile scanning.

What about utility companies mapping their assets?

Yes, we work with businesses that need to manage some kind of infrastructure or a large collection of assets. Water companies are very big users. They have many undocumented areas and a lot of people working in the field. For them, it’s crucial to have an affordable system that they can put in the hands of untrained people. Also, fiber optic networks, gas pipelines and agricultural companies have similar demands.

Today, a traditional RTK GNSS receiver costs at least $20,000. Our Reach RX is $2,000; our Reach RS3 with tilt compensation is $3,000. This completely changes the game. So, we are opening this field for professionals, for architects, for landscape designers, for agricultural applications. We’re seeing archeologists use it. These guys would have never bought a system for $20,000 or $30,000. Now that it’s $2,000 or $3,000, it’s a different story.

What do you make specifically for GIS?

We recently introduced the Reach RX MFI, which is certified for use with Apple devices. This Reach RX integrates natively with Esri’s ArcGIS Field Maps, the most common platform for GIS data collection workflows. It required certain hardware modifications to connect to iPhones natively and some integration work with Esri. It is another way in which our Reach RX receiver can be used. Every one of our Reach RX is now a Reach RX MFI.

Tell me about the Pix4D.

We have a kit that consists of two parts. The hardware part is our Reach RX centimeter-grade, survey RTK receiver. The software part is the PIX4Dcatch mobile app on an iPhone Pro or Pro Max, which has a lidar sensor and a very good camera. As a part of the kit, you receive a bracket to mount everything together, forming a unique system that is easy to use, accurate and affordable. It uses the lidar for scanning.

And the sensors in the phone to determine its attitude …

Yes, and the huge photogrammetry experience that Pix4D has. They’re using their full photogrammetry engine to process the pictures, along with the lidar from the iPhone and highly accurate GNSS, which allows them to stitch together essentially survey-grade models just using this simple set of equipment.

I’m very excited about this technology being so accessible and easy to use.