No audio available for this content.

An exclusive interview with Chad Huedepohl, precision agriculture portfolio manager, Autonomy & Positioning division at Hexagon. Read the full story and additional exclusive interviews here.

Precision agriculture has been around for more than 30 years. (GPS World published several issues of a supplement on the subject about 26 years ago.) What have been some of the key turning points? What options do farmers have now that they did not have, say, five years ago? Are the main improvements in accuracy, repeatability, reliability, or cost?

The term precision agriculture started to come into play when yield monitoring was first invented and brought to market. One of the first successful ones was through Ag Leader Technology and their yield monitoring system, which then added positioning through GPS to start mapping where the yields were coming from. This then created the ability to start managing farmland and zones based on productivity. In turn, this very quickly evolved into also mapping soil sampling results and directly tying that type of information to point-specific yield information from a field. Auto-steering systems had been on the market prior, but really started becoming part of the precision agriculture portfolio in the late 90s.

The industry took off in that direction for several years, then started to get into variable rate application of fertilizer, which was another way of more intimately managing the farmland. That then led, in the early 2000s, to the coming to market of auto-swath technology, which made it possible to turn on and off the different implement sections on application equipment — primarily, sprayers and spreaders. This enabled the operator to avoid putting a second application where you had already been, as well as making sure you had full coverage and no skips.

In the mid-2000s, autosteering systems started to become standard on newer equipment and soon became a key product in the aftermarket. Auto-steering had a major impact on farmers because it gave them better efficiency, but also helped provide more hours of productivity per day. It enabled them to focus on other things and not be so physically and mentally drained by the end of the day because of constantly concentrating on where the machine had to go. It allowed them to pay better attention to the equipment and the application that they were set up to do.

So, the combination of swath control and auto guidance is what sent the precision ag world into major acceleration, which eventually led to planter control. The company Precision Planting emerged into the precision ag space at about that time, drawing awareness of the need to utilize precision on row-crop planters. The industry soon started getting into much more finite monitoring and precision ag soon became an integrated featureset into planter equipment, rather than just an add-on.

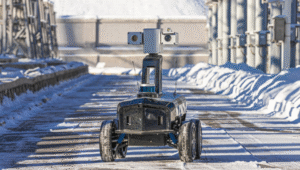

More recently, we’ve started the trend toward autonomy. It’s not mainstream yet, though. We started putting a lot more focus on live sensors, including camera imagery. There’s been some evolution toward sensors on the implements that make those decisions on the go. It’s catching on somewhat. It still does not have a whole lot of market penetration, yet that’s changing rapidly.

When it comes to GNSS, I think the biggest part has been reliability — on a farmer’s terms. “Can I really count on this system to do what I’m asking it to do?” Farmers view that as reliable in the GNSS world. We then start asking, “What is reliable? Is it accuracy? Is it repeatability? Is it integrity with the actual position?” Growers think about all those things. They do not necessarily focus on one thing versus another.

In terms of the integration, of how they use it in the cab, reliability has had the biggest impact on that, then cost has brought in more people. In the early days, just autosteering cost north of $20,000. Nowadays, a complete systems will cost somewhere around $20,000, so the out-of-pocket cost has not necessarily come down a lot, but what you’re getting for that value has advanced significantly. If you want to do just entry-level autosteering, that can be done relatively inexpensive compared to the early days.

Most growers today are doing far more than just navigation.

I was familiar with this history because I’ve written a dozen articles on precision ag over the past 20 years, but the way you summarized it was great. One thing you didn’t touch on, however, is the vast expansion in options for corrections data.

I’m glad you brought that up. Corrections have been an important part of the evolution of precision agriculture as well. When farmers plant this field or spray that field, they want it to be done reliably. That is where accuracy comes in. Earlier in my career, real-time kinematic (RTK) positioning was very expensive and satellite-based augmentation systems (SBAS) were not as stable.

Also, RTK systems and such used just single constellation for the longest time. We started adding in GLONASS and then positioning correction providers, which gave us a lot more robustness. Some of the early challenges with RTK were having enough common satellites with baselines. I think that really took off in about 2009. Prior to then, it was mostly just SBAS or RTK.

There was also PPP, but the challenges that the industry was facing with PPP was the long convergence time. It used to be common for conversions to take 40 to 50 minutes. Then you would drive underneath one tree on the edge of a field and you had to start all over. When you’re talking about the actual cost of a farming operation, having to sit idle because of something like that did not sit well with farmers. So, PPP corrections struggled to take off. Because of those early experiences, it took a long time for the market to start to accept the newer PPP models that we’ve seen in the last, say, seven or eight years.

Now there are farmers who enjoy the reliability of those PPP corrections, because the redundancy and resiliency between the different providers, such as Hexagon providing TerraStar services, through vegetation and being able to withstand some outages, definitely sits well with customers.

The accuracy and convergence times have also improved significantly. At the end of the day, it’s one fewer thing that can go wrong for them or their dealer to have to deal with. I don’t have to worry about the state-sponsored continuously operating reference station (CORS) network going offline, about software updates or cellular issues, or, season to season, someone having to make sure that their system is all up and operational. A PPP solution is automatic. It either works or it doesn’t. That’s something that farmers like. They don’t like to have to deal with all this other integration technology.

What’s PPP’s convergence time now?

With TerraStar-C PRO, we’re often seeing a convergence time of less than five minutes. We have a fast startup time. So, if the tractor was shut down, already converged and you turn it back on, most people are going to be reconverged in just a minute or two.

That’s a hot start.

Yeah, right.

Precision agriculture involves collecting data (on the ground and from the air), analyzing the data, creating maps, displaying the maps in the cabs of tractors and other machines, and using the maps to guide those machines as they water, spray, plant, and harvest crops. So, it involves hardware, software, data, analyses, and decisions. Besides making GNSS receivers and providing corrections via TerraStar, in which aspects of precision agriculture is Hexagon involved? For example, do you store and/or analyze any of the data that growers collect or create maps for them?

We sell displays and controls that operators use that control equipment and collect the data for the farm. Many of our agriculture OEM and technology customers have their own software solutions that provide their crop growers with the tools they need to manage their farms, and Hexagon provides the hardware that feeds into them. However, Hexagon does have a software portfolio that provides tools for operation planning, monitoring and analysis to large enterprise farming customers like those in the sugarcane, bioenergy and forestry industries. In summary, we sell the control equipment — basically, the display interface — as well as rate control and implement control functionality. We sell the TerraStar PPP corrections as well as RTK corrections through Hexagon’s SmartNet.

Do you have any unit that does a service for the growers of analyzing that data and creating the maps they use for planting, watering, and spraying?

No, Hexagon does not provide any after-the-fact data analysis, certainly not for row crops.

How is the adoption of precision agriculture proceeding in the United States? For example, roughly what percentage of growers currently use autosteer on their tractors?

I don’t have any reports to reference other than those from USDA. Adoption rates across most row crops in the United States are going to typically be north of 70%. On machines built in the last five years, you’re talking about an adoption rate of more than 90%. Acres of crops grown using auto steer are probably 80% in North America. More than 50% of that is using a correction that is more accurate than just simple SBAS.

What is the division of labor between Hexagon and the manufacturers of tractors, combines, sprayers, and other agricultural machines – such as John Deere, AGCO, Case IH, Kubota, Massey Ferguson, etc.? Do you have privileged relations with any of them? Are your guidance systems typically installed at the factory or by dealers?

We go to market in a couple different ways, and we’re involved with most of the leaders in precision agriculture. We’re providing solutions t — whether OEMs, regional OEMs, or after-market solutions. So, we’re involved in most of the leading precision agriculture solutions in the global market.

OEM solutions are factory-installed and the grower doesn’t even see the name Hexagon anywhere, correct?

That is true in many or our partnerships. We are a factory option and some of the leading OEMs do both white label as well as branded. We’ve been providing NovAtel branded receivers to AGCO for many years, through their channel, both factory-installed and aftermarket. Some of the others, such as CNH, are white labeled, so it would just say “Case-IH” or “New Holland” and have no Hexagon markings.

Is the aftermarket phasing out as it becomes standard for these solutions to be factory-installed on new machines?

Yes and no. In some ways, there is more adoption of aftermarket products to pair with the mainline factory systems, but many of the shorter line OEMs and aftermarket solutions are accessing parts of the market that have machines that originally came with factory-installed solutions that are now antiquated, so they want to upgrade to get more out of it.

You also have increasing consolidation — such as AGCO’s joint venture with Trimble and CNH’s acquisition of Hemisphere — so there are fewer GNSS providers for competing brands to utilize in the market.

Does the signal into the autosteer use the NEMA standard, so that you can just replace the old receiver with a new one?

Most of the companies, whether they’re OEMs or aftermarket solutions, have some type of proprietary integration. There are products that are just NEMA; they are typically at the lower end and priced much lower. The higher performing flagship products are usually doing a more customized integration.

Would you like to highlight any recent Hexagon products or services in the precision agriculture area?

Probably the biggest one is bringing more awareness to the TerraStar-C PRO and the TerraStar-X Corn Belt products and a lot of the ionospheric resiliency that we’ve been able to improve with those products. They provide more robustness and reliability in challenging ionospheric scenarios. Especially in the Brazil market, some growers were often experiencing hours of downtime due to ionospheric scintillation. With the ionospheric enhancements that we’ve added that downtime now is down to just a few minutes here and there.

Another one would be enhancements that we’ve been bringing to the autonomy market, such as dual antenna solutions and geofencing, for safety.

Who integrates the other sensors used for safety, such as lidar or radar?

That’s a key area we’re focusing on. We are currently working with specific integrators with our perception system. We have perception systems that primarily utilize cameras, but we can also utilize lidar and other sensors.